Top 100 Reasons To Own Burial Insurance

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Are you you wondering if burial insurance is right for you?

Are you looking at getting coverage on yourself or a loved one?

If so, I’m going to give you…

100 Reasons Why You Should Own Burial Insurance

Burial insurance provides coverage to your family to pay off funeral and cremation expenses.

Burial insurance is life insurance, specifically designed to pay for any final expenses when you pass away.

And with more Baby Boomers aging into their retirement years than ever, and with almost 25% having no retirement savings whatsoever, getting a life insurance plan to take care of final arrangements is very important.

So, let’s jump right in and discuss the 98 reasons why owning burial insurance is a great idea.

Reason #1 – Burial insurance is affordable

Many of my retired clients wonder, “Is burial insurance affordable?”

The good new is it IS affordable… IF you know where to look.

The secret to buying affordable life insurance is to work with independent agents.

They shop the major carriers to find the best combination of price and coverage for you. In return, you may get MORE coverage at a BETTER price than you’d find elsewhere.

Reason #2 – Almost everyone gets approved

Have you or a loved one experienced health issues?

Are you wondering if your too old to qualify for coverage?

Even if it’s been years since the event, you may experience difficulty getting approval at reasonable rates with many life insurance products.

Unlike traditional life insurance, health doesn’t matter as much when qualifying for burial insurance. There are even final expense insurance products that ask no health questions and guarantee your approval!

And age is much of a factor, either. As long as you are 85 years old or younger, you’ll have access to most burial insurance products.

Reason #3 – Young people may qualify, too.

Burial insurance isn’t only for the elderly.

Are you in your 40s or 50s, and concerned about final expense protection?

Or do you have adult children you’d like to get protected?

We at Buy Life Insurance For Burial have access to final expense policies that will middle-aged and younger adults.

So, if you’re not of retirement age, you have inexpensive burial insurance options available to you.

Reason #4 – “Not-so-young” people

Have you wondered if your advanced age will prevent you from qualifying for life insurance?

With some coverage, this is certainly the case.

But now with burial insurance.

We have access to many products that insure folks all the way to 85 years old.

There’s even a few that offer coverage all the way to 90 years old!

Don’t let age excuse you from getting the peace of mind you’re looking for.

Reason #5 – It’s easy

Technology has made purchasing burial insurance easier than ever.

Gone are the days when an insurance salesman would visit.

Now you can do the entire burial insurance policy over the phone and through email.

This buying process puts the power in your hands, eliminating the sales pressure you may experience dealing with a face-to-face salesman.

We here at Buy Life Insurance For Burial offer burial insurance coverage where we require either an electronic application or telephone interview to reach a decision.

It’s quick, it’s easy and very convenient. And our clients love it!

Reason #6 – Agents can visit, too.

Working with a good insurance agent makes a huge difference for many.

And while technology has eliminated the need for a face-to-face visit, there are plenty of agents that will personally visit with you.

Perhaps it’s just old fashioned. Some folks like seeing who they’re doing business with.

Of course, there’s nothing wrong with that. And the good news is there are plenty of agents willing to meet you face-to-face to help with your burial insurance options.

Reason #7 – Get it through the mail

Is the LAST thing you want to do is deal with a salesperson?

If so, I understand! Some salespeople are frustrating pests.

Luckily, you can purchase life insurance through the mail without ever talking to a single soul.

Have you heard of Colonial Penn, Trustage Life, Globe Life, or AARP?

All offer burial insurance and term insurance for seniors through a mail-order process. All that’s required is to complete the application and mail it back.

Just make sure to read the “fine print” of these policies before pulling the trigger.

Reason #8 – Gift of love

Burial insurance is a gift of love.

If you REALLY think about it, you want burial insurance to eliminate your survivors’ responsibility of paying your funeral expenses.

In other words, you are thinking ahead, considering the pain they’d experience, and actively DOING something about it.

If this isn’t the definition of LOVE, I don’t know what is.

By taking action NOW to make your family’s life easier upon your passing is a noble thing to do.

That’s why many consider life insurance as a gift of love because of what it does for those important in your life.

Reason #9 – Burial insurance coverage flexible

Burial insurance allows for custom-tailored experienced.

For example, burial insurance isn’t just about paying your burial expenses.

You can use your final expense life insurance coverage to pay for your cremation, too.

You don’t even have to purchase burial insurance to cover your burial costs!

Many use it to pay off non-funeral related costs, or to simply leave money to family upon passing.

Bottom line, you can use burial insurance for many reasons. And those reasons are entirely up to YOU!

Reason #10 – Cover expensive funeral services

You can cover high cost funerals with burial insurance.

Did you know you can purchase caskets designed to look like Jack Daniel’s bottles, or have Star Wars images imprinted on the outside of the casket?

It’s true. And as you can imagine, custom-designed caskets added together with more elaborate funerals will increase your funeral bill well beyond the average.

I’ve seen burial insurance with specialized caskets and funeral services that cost between $25,000 to $35,000! Plus some cultures such as the Hmong have unique funeral rituals, requiring more burial insurance coverage to carry the entirety of the cost.

Thankfully, if you plan to have a higher-than-average burial cost, we at Buy Life Insurance For Burial have access to insurance companies that offer higher-coverage burial insurance.

If you are looking for $25,000 to $50,000 in burial insurance coverage, we can help. If you want more, there are options for more coverage, too.

Reason #11 – Coverage for cheap, direct cremations

A big trend in the funeral business is the growing percentage of people who opt for cremation over burial.

By the year 2030, National Funeral Directors Association says 50% of people will opt for cremation.

Why is this the case? Chiefly because of how expensive burial services are.

Direct cremation greatly reduces your final expenses when compared to a traditional burial. You receive minimal to no services with your direct cremation.

Costs typically range between $1000 to $2000 for a direct cremation.

And with burial insurance coverage starting at $1000 in minimum coverage, you can insure against the cost of a direct cremation with a burial insurance plan.

Reason #12 - Covers traditional cremations

You may not like the idea of a direct cremation.

Perhaps you want a cremation, but you want a traditional service, as well.

Burial insurance covers traditional cremations, too.

According National Funeral Directors Association, the average cost of a traditional cremation is $6,500.

With many people purchasing burial insurance within the $5,000 to $10,000 budge range, you can easily cover your cremation costs.

Remember, just because it’s called “burial insurance” doesn’t mean you have to get buried. You have full control over your final arrangements.

Reason #13 – Income replacement

You have full control over what you want your burial insurance policy to do.

While covering funeral-related costs is important, replacing lost income is a common reason why people own final expense life insurance coverage.

Ask yourself… how would your spouse’s standard of living change when you pass away?

Would she be better off or worse off?

If you answered “worse off,” then consider using a final expense plan to leave money to your spouse.

Many widows have a difficult time surviving after their spouse passes away. And losing your regular Social Security check adds economic suffering on top of emotional suffering.

You can designate your burial insurance plan to replace income you otherwise would have earned. This eases the financial transition for your surviving spouse, and greatly eliminates economic suffering.

Reason #14 – Surprise a loved one

Burial insurance is as an act of love.

Prior my grandfather passing away at 85 years of age, he purchased a $7,500 life insurance policy and put my mom as the beneficiary.

Receiving notice of this, Mom was thrilled. While she didn’t expect the payout, it was perfectly timed, as she was in desperate need of a new roof on her home. And my grandfather’s life insurance policy was the prefect act of love.

From personal experience, I assure you that your loved one receiving this act of love would make a huge difference in their lives like it did in my mom’s.

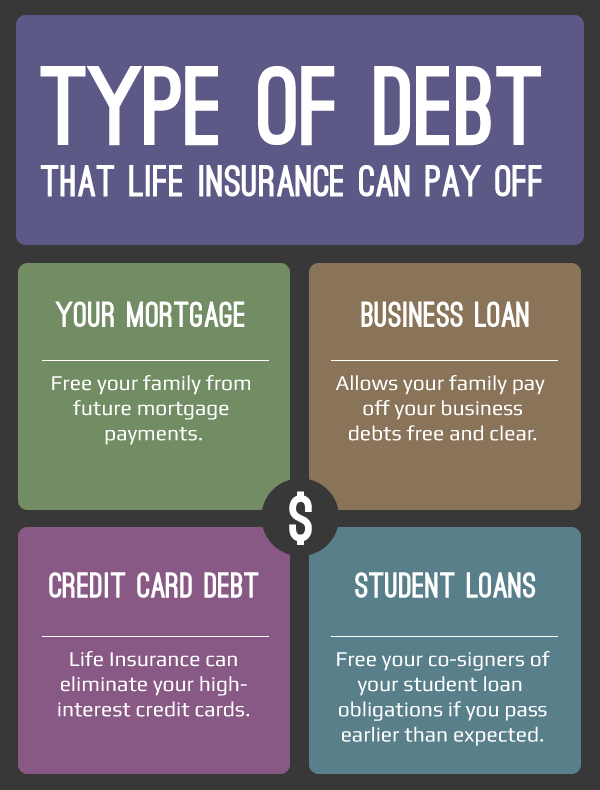

Reason #15 – Pay down credit card debt

Do you have existing credit card debt? Worried you won’t live long enough to pay off?

A burial insurance policy payout can cover credit card debt.

Reason #16 – Pay down the mortgage

Ever wonder how your surviving spouse could cover the mortgage without your monthly income?

If so, consider owning burial insurance as a “mortgage payment protector.”

Here’s what I mean.

Let’s say you’re paying $500 a month for you mortgage.

You buy a $20,000 final expense life insurance plan, giving you more than 3 years to pay your mortgage before hitting zero.

A mortgage payment protector program allows your surviving spouse or family to continue making the mortgage payments without the stress of selling the house at a discount, or facing foreclosure.

Reason #17 – Leave money to grandchildren

If you want to leave a legacy behind to your grandchildren, burial insurance is the answer to it.

Leaving a small amount of money to a grandkid like $5,000 or $10,000 will go long way.

Sometimes life is tough. And getting them started on the right foot is always something your grandkids will remember and appreciate.

Reason #18 – Solve estate problems.

I had a client in Northwest Georgia who owns around 500 acres her son lives on.

Ideally, she wants to split the land evenly between her son and grandson, but the grandson has no interest in the land, and becoming a part-owner will put him and his father at odds.

Instead, she opted for a burial insurance plan to leave a large cash-benefit to her grandson as his “share” of the estate, while leaving the land to her son.

This eliminates the estate concerns she had, and any future strife between family members.

Reason #19 – Income replacement for dependent child

If you have a child with special needs, how will he be taken care of when you pass away?

Consider purchasing a life insurance plan. You can leave a large lump sum to a trusted care provider, and give yourself peace of mind, knowing your child will be well-taken care of after you pass away.

Reason #20 – Pay off your mortgage

We discussed how burial insurance can handle mortgage payments.

You can also buy a burial insurance plan to pay off ALL of your mortgage, too.

If your goal is to have your spouse or family own your home free-and-clear, burial insurance offers significant coverage to accommodate paying off many sizes of mortgages.

Reason #21 – Coverage for those in bad shape

Do you or a loved one suffer from a debilitating disease?

Burial insurance is well-known for its underwriting flexibility in covering even the most difficult health issues.

Even if you’ve been declined for life insurance elsewhere, burial insurance may offer coverage that few other life insurance products will ever consider.

We at Buy Life Insurance For Burial can easily offer coverage to the following applicants:

- COPD (chronic obstructive pulmonary disease), emphysema,

- Diabetes (Type 1 or Type 2)

- Heart history (strokes, stints, bypasses, aneurysm, pacemaker, seizures),

- Cancer history (internal or external),

- Neurological disease (lupus, Parkinson’s, multiple sclerosis),

- Liver and kidney problems (hepatitis, cirrhosis, dialysis), and

- Mental health (depression, PTSD, anxiety, bi-polar schizophrenia)

If you’ve ever been declined for life insurance before, definitely check out burial insurance. The process is much smoother and easier to qualify for.

Reason# 22 – Cancer survivors may qualify

People with history of cancer may qualify for burial insurance coverage.

The types of coverage you may qualify for vary, but it is an option at most ages.

Reason #23 – Current cancer patients may qualify

Cancer patients can qualify for burial insurance plan.

Granted, all you’ll qualify for are guaranteed issue life insurance plans, but something is better than nothing.

Reason #24 – Declined for coverage? Burial insurance can help.

If you’ve been declined for life insurance elsewhere, we’ve got good news.

Burial insurance does a fantastic job covering folks declined for traditional life insurance coverage, all at an affordable rate.

Even if you were declined elsewhere due to age, weight, or health problems!

It’s likely you’ll have an easier time qualifying for burial insurance coverage.

Reason #25 – Have heart disease? Burial insurance can help.

Have you had any of the following heart history issues:

- Heart attacks

- Strokes

- Stints

- Bypasses

- Seizures

- Aneurysms

- Pacemaker implant

- Congestive heart failure

If so, burial insurance may qualify you, even if your heart disease event was less than a year ago.

While not all burial insurance companies will offer first-day full coverage, it more than possible to get high-quality burial insurance despite your heart ailments.

Reason #26 – Take lots of medications?

Many traditional life insurance companies are skeptical of applicants taking several medications daily.

And many medications will cause traditional life insurance companies to raise your premium or flat out decline you.

The good news is most burial insurance companies are understanding when it comes to medication usage. We at Buy Life Insurance For Burial have insured hundreds of people that take a half-dozen or medications daily.

So if you take a lot of medications, you may have an easier time qualifying for burial insurance coverage.

Reason #27 – Mental health issues OK for coverage

Have you suffered from depression at some point in your life?

Do you deal with PTSD, bi-polar, or schizophrenia?

Normally, these conditions are much harder to get approval.

Luckily, with final expense life insurance, mental health issues are some of the easiest to get qualified.

In fact, many insurance companies we work with will offer preferred coverage to folks with mental health issues.

Reason #28 – Hate insurance salespeople? Great!

Insurance companies now allow applicants to take out burial insurance without a face-to-face interaction with an insurance salesperson.

At Buy Life Insurance For Burial, the entire application process for final expense life insurance coverage takes place via email or telephonically. No face-to-face appointment is required.

You simply find the insurance quotes you like, apply, then wait for the decision.

Reason #29 – Love insurance agents? Great!

Not everyone hates insurance agents.

You may like working with insurance agents, getting personalized attention.

Plus, you may be the type that likes doing business the old fashioned way, face-to-face with someone, versus over the phone or through the mail.

Reason #30 – You don’t need a lot of coverage

The average burial insurance policy size we at Buy Life Insurance For Burial offer our clients is around $10,000.

However, not everyone needs that much coverage.

Maybe you want low-cost cremation, or want to supplement your existing coverage with a second policy.

Either way, smaller-sized coverage amounts are available. You can go as low as $1000 in burial insurance coverage with some companies.

Reason #31 – You want a LOT of coverage

Need a lot of life insurance coverage? Looking for $25,000, $50,000, or more?

With final expense life insurance, getting large amounts of coverage is rarely a problem.

If you’re planning on an elaborate funeral service, need income replacement, or need a mortgage pay-down policy, we can certainly arrange for you.

Reason #32 – No exams necessary

Burial insurance does not require an exam.

Most final expense insurance companies review the Medical Information Bureau for your medical records over the past few years to determine insurability.

That means no blood withdrawal or physical exams are necessary.

Simply complete the application, and allow the company a day or two to review your medical records to determine your eligibility.

Easy-peasy!

Reason #33 – Get fast approval

Want to get coverage today?

With burial insurance, it’s possible.

Many companies offer a same-day approval process, eliminating the the weeks to months-long decision-making process traditional life insurance imposes on applicants.

Worst-case, you may experience a 2 or 3 day wait to get an underwriting decision on your final expense life insurance plan.

Reason #34 – Many options

When you work with the right agent, you’ll have many coverage options to choose from.

That’s why Buy Life Insurance For Burial operates as a final expense life insurance broker.

We don’t want to represent just one option for coverage. Odds are that option will NOT be your BEST option!

Instead, we have many burial insurance options to choose from. This allows us to shop for you, to find the best-value policy for your unique goals.

Working with a broker allows you the best opportunity to get the most coverage for the most competitive price with a high-quality insurance company.

Reason #35 – Flexible with health history.

Have health history issues?

Even if you’ve had a history of health problems, burial insurance is typically an easier product to qualify for.

Most companies have a 2- to 3-year look-back on health history events.

For example, if you’ve been cancer-free for 2+ years, you may qualify for first-day full coverage.

Finding a traditional life insurance plan to do that is next to impossible!

And even if you’ve had recent health issues, Buy Life Insurance For Burial has access to no-questions asked life insurance to help folks get coverage, even if you’ve been declined in the past.

Reason #36 – Short and sweet application

Ask any insurance agent.

Nothing is more frustrating than a lengthy, 40+ page application.

The more papers to sign, the more errors you’ll experience. And errors cause setbacks and delays in getting your insurance coverage.

Final expense life insurance is known for its quick and easy application.

With these types of policies, they typically take 5 minutes to complete online, or 15 minutes to complete over the phone.

The idea is to keep everything simple!

Reason #37 – Immediate coverage options

Have you ever got any of the dreaded “Junk Mail Insurance” company offers for burial insurance?

You’ve probably seen TV ads and junk mail from Colonial Penn. You know, the company Alex Trebek endorses.

Companies like Colonial Penn who advertise through the mail on TV commonly offer plans that RESTRICT coverage for natural death until 2 years have passed.

Regardless if you’re in top-notch health, you do NOT have full coverage if you die from natural causes within the first two years.

The good news is that working with an insurance broker opens up your options tremendously.

While not 100% guaranteed, you may find it MUCH easier to qualify for first-day full natural death and accidental death burial insurance coverage.

Reason #38 – Auto-draft options available

Virtually all burial insurance companies allow you to pay monthly on an automatic basis.

If you despise the idea of sending a monthly check for your insurance, this is now a thing of the past.

You decide which day of the month works best to set up your payment.

From there on out, the insurance company will process your payment as sure as the sun rises.

Reason #39- You HATE bank drafts

Maybe you’re the type that hates bank drafts.

Lots of people have stories of bank drafts messing up the accounts of many, causing overdrafts, and general frustration.

If you refuse to set up bank drafts, no problem! Most final expense life insurance companies accept direct bills on a quarterly, semi-annual, and annual basis.

Reason #40 – Payment options for Direct Express, Debit Cards

Do you receive your Social Security or disability check on a Direct Express card, or another type of checkless checking account?

The good news is that many burial insurance companies allow non-checking account payments via debit or credit cards like Direct Express.

Reason #41 – Coverage for mom

Thinking about purchasing burial insurance for your mother? Worried about coming out of pocket for her funeral expenses?

No worries. You have access to programs that can insure your mother for final expense insurance and allow you to pay the premium (if you’d like).

Buy Life Insurance For Burial can insure women up to age 90, so we can help many with insuring their mother.

Reason #42 – Coverage for dad

Perhaps your worried about getting coverage on your dad.

If that’s the case, final expense options exist for Dad, too.

Whether you want to cover your dad’s burial, cremation, or other final expenses, a life insurance policy on your dad may make perfect sense.

Reason #43 – Burial insurance for your wife

Are you married and worried about your wife passing away without adequate final expense protection?

Burial insurance coverage is the answer. Regardless of health or age (up to 90 years old), you have final expense options available to cover your wife. Which can eliminate the burden of paying for your spouse’s funeral.

Reason #44 – Final expense coverage for your husband

Maybe you have a stubborn husband who doesn’t think burial expenses won’t cost too much.

“Throw me in a ditch when I die!” is the common objection I hear from some of the “saltier” older men I meet.

Joking aside, burial insurance is super important for your husband, too.

And if you work with a broker like Buy Life Insurance For Burial, we shop his coverage options to find the best combination of price and value.

So if he’s reluctant to spend much money, he’ll appreciate us going to bat for him to find him the best deal.

Reason #45 – Worried about your siblings?

Have a brother or sister who “lives on the wild side?”

Or maybe your sibling struggles to make ends meet, and you worry if they pass away without burial insurance that the bill will end up your responsibility?

Here’s the good news. You can get your siblings life insurance coverage to pay for final expenses.

Of course, they will have to agree to the process and sign off on getting the insurance. And once they do that, the sky’s the limit on the number of options available to them.

Reason #46 – Quit smoking and get a better premium

Planning on quitting smoking in the next 3 years?

There is a new burial insurance program that grants you non-smoking rates as a smoker as long as you promise to quit smoking within the next 3 years.

Obviously, the downside is if you DON’T quit smoking, you’ll get stuck with a smoker’s premium increase.

But at least you have some motivation now to quit!

Reason #47 – Recent hospitalizations OK

Have you been recently hospitalized for a surgery or procedure in the past 12 months?

As long as the surgery or procedure wasn’t for a major illness, it is likely you’ll qualify for first-day preferred rates.

And even if it was a serious surgery, you’ll still have access to a no-questions asked whole life burial insurance plan that guarantees your approval.

Reason #48 – Burial insurance is perfect coverage for young kids

Interested in getting your newborn grandchild life insurance coverage?

If so, there are several options for final expense life insurance on your grandchildren.

Mutual of Omaha offers an inexpensive grandchild policy for a few bucks a month.

Reason #49 – Coverage for teenagers

Got teenage kids or grandkids?

Unlike traditional life insurance products like term life insurance, burial insurance poses no coverage limitations or means testing to determine if insurance is necessary.

Bottom line – you want coverage on your teenage kids, then you can get it with final expense life insurance coverage

Reason #50 – Smokers may qualify for good rates

If you smoke, you’ve probably wondered how much more expensive insurance may cost you.

The good news is not that much.

Final expense life insurance companies have become competitive with smoker rates in recent years.

Now more than ever, it’s easier to get a smoker qualified at competitively-priced, preferred rates.

As with many of my suggestions, I recommend working with a broker like us at Buy Life Insurance For Burial.

Smoker rates vary wildly, and you want to ensure your quote is a solid combination of quality and price.

Brokers are able to shop the major final expense life insurance companies to see which company offers smokers the best rate.

Reason #51 – Some tobacco users may qualify for non-tobacco rates

Do you chew tobacco, dip snuff, smoke a pipe or the occasional cigar?

If so, there are several burial insurance companies that offer tobacco users who don’t smoke cigarettes non-tobacco rates.

This advantage alone may save the non-cigarette tobacco hundreds of dollars annually on burial insurance premiums.

Reason #52 – Lung disease may qualify for coverage.

Do you suffer from COPD (chronic obstructive pulmonary disease), asthma, emphysema, sarcoidosis, or any chronic lung disease?

Ever wonder if burial insurance would consider covering you?

Great news! Many final expense plans will cover those with ANY chronic lung disorder with first-day full coverage for natural and accidental death.

With many companies, this is NOT the case. Instead, you’re put on a two-year waiting period for natural death. That’s not good!

Reason#53 – Sleep apnea patients may qualify for burial insurance

I have personally met with many applicants with sleep apnea. Many times other life insurance companies declined them for coverage because of the sleep apnea.

Final expense life insurance has easy underwriting with sleep apnea applicants.

Even if you use a c-pap, many companies will happily take your insurance business.

Reason #54 – Diabetics may qualify for a policy

Do you have diabetes? Are you insulin-dependent? Have you ever had diabetic complications like diabetic neuropathy?

Many diabetics I’ve met through the years have expressed great concern over qualifying for life insurance.

The truth is burial insurance is not difficult for diabetics to qualify for.

I’ve insured all sorts of diabetics in my career – Type 1, Type 2, and those with diabetic complications. In many cases, I’m able to get them first-day full coverage, too

Reason #55 – Insulin users may qualify for coverage

Insulin users – even Type 1 diabetics – will find qualifying for burial insurance much easier than qualifying for term life, whole life, or universal life insurance coverage.

Reason #56 – Obesity easier to qualify for a policy

Do you think your weight will keep you away from qualifying for burial insurance coverage?

The good news is that’s typically not the case.

There are many final expense providers that have flexible weight allowances. And some don’t even care about weight.

Reason #57 – Disabled veterans may qualify for good coverage

Are you a disabled veteran?

Whether you were disabled in the theatre of combat, or disabled through getting hurt or sick on the job, you will have access to quality final expense life insurance.

Currently, there are no insurance products disabled veterans can purchase from the Federal Government to help offset burial costs.

And while there is a program to help offset some costs associated with burial at a national cemetery, the need for more coverage still remains.

Reason #58 – Disabled workers may qualify for coverage

Did you get hurt or sick on the job, and qualified for Social Security Disability?

The good news is that disability alone is NOT a determining factor for coverage eligibility with most final expense carriers.

In fact, a large percentage of my clients were forced into retirement due to an accident.

And while many people appreciate disability coverage to replace income, it does not replace the work benefits you received like your life insurance.

And since most who file for disability lose their employer-based life insurance coverage, buying burial insurance is a great idea to give you peace of mind and eliminate the fear of loved ones paying out of pocket for your final expenses.

Reason #59 – You choose the beneficiary

Did you know that funeral home pre-need policies force you to make the funeral home the beneficiary?

With final expense life insurance, you’re in full control of who you name as your policy beneficiary.

Insurance companies cannot force you to choose one person over another. If you want to name your spouse, child, grandchild, or any other family member as our beneficiary, that’s fine.

As long as the your beneficiary has an “insurable interest,” they are eligible. An insurable interest is someone who could be negatively impacted by your demise.

Reason #60 – Funeral homes rarely are named beneficiaries

A lot of people confuse burial insurance with funeral home insurance.

When you buy a burial insurance plan, you’re not dealing with the funeral home. You’re dealing directly with an insurance company.

That means you have full control of your policy, including who you want as your beneficiaries.

Reason #61 Former smokers may qualify for non-smoker rates

If you’ve quit smoking for at least 12 months, you may qualify for non-smoker burial insurance rates.

This is much improved relative to traditional life insurance coverage that forces you 3 years or longer before you may qualify for preferred rates.

This option for non-smoking coverage so quickly may dramatically lower your life insurance rates.

Reason #62 – Many policy options

In the final expense insurance business, there is not “one-size-fits-all” approach.

The agents that get the best results for their clients are brokers, having multiple burial insurance options for their clients.

You benefit by having a better chance to qualify for more competitively-priced, better-quality final expense insurance. This is especially the case when compared to “one-trick-pony” agents that only offer one burial insurance option.

Working through an insurance agent broker like us at Buy Life Insurance For Burial allows you to find the best price and value of coverage.

Reason #63 – Protection against inflation

Did you know the average price for a burial has increased 25% in the past 10 years?

The average price for burials and cremations has increased tremendously over the past 20 years, with no signs of slowing down.

Smartly-designed burial insurance policies factor rising prices into their program. Agents start you with more coverage to begin to offset future price increases, and give you a lock on rates that will never increase.

Reason #64 – Lupus sufferers may qualify

Do you or a loved one suffer from systemic lupus (SLE)?

If so, you will have multiple options for burial insurance coverage.

Some will grant you first-day full natural death coverage if you qualify.

Reason #65 – Multiple sclerosis sufferers may qualify

Do you or a loved one have multiple sclerosis?

If so, there are a handful of final expense insurance companies that offer first-day full coverage in best-case scenarios to applicants with MS.

Reason #66 – Coverage available to the elderly

Are you or a loved 80 year old or older?

Think you’re too old to qualify for life insurance?

Think again!

Buy Life Insurance For Burial has access to several carriers that will write folks 80 to 90 years of age.

Reason #67 – Coverage available to Baby Boomers

If you are 65 years old and older, you have the most options for burial insurance coverage.

Most likely you’ll lose your group life insurance plan at 65, or possibly see your term insurance cancel as you outlive the coverage.

Because of this, buying a burial insurance policy at or near retirement makes perfect sense.

Reason #68 – Need more coverage than work provides

Did you know that most life insurance purchased at work does NOT go with you once you leave or retire?

And many times, even if it does, it is only good to 70 years of age, since the most basic employer-based life insurance coverage is term life insurance.

If you are worried about having life insurance at retirement to cover final expenses, consider purchasing a burial insurance policy.

Unlike employer-based benefits, your burial insurance is a private policy. Where you work has no bearing on whether or not you keep the coverage.

Reason #69 – Worried about losing your disability check? Don’t be.

Have you heard rumors about losing your life insurance if you’re on Medicaid?

Allow me to explain what the fuss is all about.

Depending on your state’s Medicaid program, you have certain cash and cash-equivalent maximums you must follow to continue receiving Medicaid.

If you don’t, you risk losing your Medicaid.

Because whole life burial insurance falls under the “cash-equivalent” definition due to its cash value component, there is a risk that your life insurance may risk your Medicaid.

Here’s how you get around it.

Have your child become the policy owner.

What this does is simple. You are still insured for coverage. But now the cash-value component shows up in your child’s name, meaning it does not count against you for your Medicaid plan.

This is the easiest solution to avoiding any troubles with Medicaid in an ethical manner.

We at Buy Life Insurance For Burial can help you with the ownership change process.

Reason #70 – Arthritis-suffers may qualify for coverage

Do you have severe arthritis, osteoarthritis, or rheumatoid arthritis?

Surprisingly, most burial insurance companies may qualify you for preferred coverage.

Over the years, hundreds of my clients have suffered from various degrees of arthritis. And I’ve never had one scenario where the insurance company declined my client due to arthritis.

While I can’t be 100% sure for you, it’s very likely that your arthritis will not get in the way for qualifying for some type of burial insurance coverage.

Reason #71 – Permanent protection for a permanent problem.

Remember… dying is a permanent problem.

Nobody yet has figured out how to stop it from happening!

And the great thing about burial insurance is it doesn’t cancel due to age or health. This is unlike many term life insurance options available to seniors, which are designed to lapse if you outlive the policy’s expiration date.

Unlike term life insurance, owning burial insurance is the way to solve our permanent problem of death. Since burial insurance doesn’t cancel due to age or health, we can count on our policy to take care of our funeral costs at any time that we go.

Reason #72 – Get a better price with an optional exam

What if you’re a senior in GREAT shape and want to get the best possible price for your life insurance?

You can opt for a burial insurance plan that allows for you to take an exam. In many cases, applying for coverage with carriers that require exams can substantially lower your premium if you’re approved at preferred rates.

Keep in mind I RARELY recommend this for most applicants wanting burial insurance.

Most will have an easier time qualifying without an exam, and won’t purchase a high-enough amount of coverage to warrant the exam in the first place.

Reason#73 – Burial insurance rates NEVER increase

How does it feel when you see your cable bill or utility bill skyrocket in price?

Feels bad, huh?

Well, for once in your life, you will NOT have to worry about increasing rates with the a whole life burial insurance policy.

Unlike junk mail term life insurance from AARP and Globe, whole life burial insurance policies are designed to never have premium increases.

It’s a great feeling to lock in your premiums and NEVER have to feel the frustration of not affording your life insurance coverage.

Reason# 74 – Some burial insurance programs offer paid up policies

Do you dislike the idea of paying for burial insurance until the day you die?

There’s a solution for that! It’s called paid-up whole life burial insurance.

The concept is simple.

Paid up plans “pay up” at a future date – usually in one single payment, 10 years, or 20 years. And once you reach the end of the paid-up period, you NEVER have to make another premium payment again!

You literally own the life insurance. Much like how you own your house or car when you pay the loan off.

This eliminates the life-long commitment to paying a premium, and helps get folks insured who otherwise hate making long-term payments.

Reason# 75 – Burial insurance builds cash value

Unlike term life insurance, burial insurance builds cash value.

With enough time, you can borrow accumulated cash value from your burial insurance plan. And what you do with the money is your choice.

I have had clients who’ve borrowed money to pay of a sudden and expensive bill, or to pay for a vacation. Since it’s your policy, it’s totally YOUR decision what you do with it.

Reason# 76 – You can never outlive your burial insurance

This is probably the biggest issue with term life insurance products for seniors.

Term life insurance ALWAYS has a future cancellation point. And it’s possible you may outlive it.

What happens then when you DON’T have coverage that you really NEED?

Since outliving your life insurance coverage is never a good idea, getting a burial insurance plan designed with whole life is the perfect solution.

Whole life burial insurance is designed never to cancel due to age or health. Naturally, you have to continue making the payment to keep the policy in force.

Beyond that, if you get sick… move… or get old… your whole life burial insurance policy ain’t changing!

Keep your premiums paid and no matter what happens, your policy won’t ever cancel due to age or health.

Reason #77 – Hepatitis patients may qualify

Have you ever had any form of hepatitis?

If you’ve ever tried qualifying for traditional life insurance, you may have been declined or rated up.

Luckily, several burial insurance companies will offer full coverage for hepatitis patients, even if you recently took treatment to cure it.

Reason #78 – You can own multiple policies

Do you already have burial insurance?

Are you wondering if its OK own multiple policies with different carriers?

The answer is YES.

Insurance companies have no control over who you decide to do business with.

I’ve had clients with 6 burial insurance policies with 6 different companies. None of the companies cared whatsoever.

Reason #79 – Open heart surgery patients have options

Have you recently went through an open heart surgery?

If so, you may think no options for final expense life insurance coverage exist.

Thankfully, that is NOT the case!

Open heart surgery patients may qualify for first day full coverage if enough time has passed.

And for those with very recent open heart surgeries – within the past 12 month to 24 months – you’ll potentially qualify for guaranteed acceptance whole life insurance.

Reason #80 – Stroke patients may qualify for final expense coverage

Have you ever had a stroke, mini-stroke, or transient ischemic attacks?

If so, several burial insurance companies may offer you coverage, depending on the length of time passed and the severity of the stroke.

Reason #81 – Stent patients may qualify

Ever had a stent placed in your heart, kidneys, or legs?

With enough time passed, you may qualify for first-day full final expense coverage with many carriers.

If the stent happened a short time ago, your best bet will be a no-questions asked life insurance policy.

Reason#83 – Pain narcotic user may qualify

Have you or do you currently use pain medication like Kardex, Oxycontin, methadone, or other narcotic?

The good news is that you may qualify for preferred burial insurance rates.

The big question surrounds the current reason why you’re taking the medication.

Do you take narcotics to treat pain from a surgery, accident, or injury? Most final expense companies will accept you.

Are you addicted to narcotics or receiving treatment? Most final expense companies will offer guaranteed acceptance life insurance coverage, or require sobriety for 2 years before offering preferred rates.

Reason #84 – A “back-up” plan if you retire or get hurt and can’t work

Think your life insurance coverage at work is sufficient?

Think again.

While extremely affordable, employer-based life insurance is not a dependable solution.

Ask yourself – what happens to your insurance if you retire, quit, or become disabled?

In many cases, you’ll end up losing your coverage as the most basic employee-based life insurance plans are only good while employed.

This is why owning a burial insurance plan as a “back-up” policy makes a lot of sense.

In case your health changes for the worse, your back-up burial insurance plan does not change with your health or work situation.

That way you always know you have some kind of life insurance on the books in case anything unexpected happens.

Reason #85 – Get a spousal discount

There are a few life insurance companies that will allow a spousal discount of both purchase life insurance together.

Reason #86 – Add your grandkids to your policy for pennies a day

Worried about insuring your grandchildren?

With a burial insurance policy, you can easily add them to your policy at the same time you take out coverage on yourself.

For small monthly premium, you can $5000 to $10000 in grandchild coverage that will pay a death benefit to cover their final expenses.

It’s a low-cost way to protect those that you love.

Reason #87 – Accelerated payoff if diagnosed with a terminal illness

Many of the final expense life insurance policies we offer have an accelerated death benefit rider.

Here’s how it works.

If you are diagnosed as terminally ill with 12 months to live (6 months to live in some cases), the insurance company pays the death benefit minus a small fee to you while still alive.

The benefit is that you are able to handle your final arrangements while alive. This relieves the burden of a family member having to pay for your funeral expenses.

Reason #88 – Fixed-income friendly

Are you a fixed-income senior?

Ever feel like you have more month than money?

If having affordable coverage is important to you, a good burial insurance policy is the solution.

Working with the right agent, you can custom-tailor your policy to fit exactly to your budget.

That way, you won’t worry about ever thinking about dropping your plan because it ends up becoming too expensive.

Reason #89 – Burial insurance is perfect for any budget

I’ve worked with thousands of folks over the course of my career in final expense insurance since 2011.

Most everyone has a budget they must keep, and don’t want to spend more than they can afford.

Burial insurance policies allow for a level of customization that help you get the right coverage at the right price.

Reason #90 – You can pay for someone else’s burial insurance

Do you want to get burial insurance for your spouse, sibling, or your parents?

Most insurance companies will allow you to pay for their coverage. All you need is their consent to take the policy out.

Reason #91- Someone else can pay for your burial insurance coverage

Are you a fixed-income senior? Do you understand the importance of having final expense coverage, but worry your budget is too tight to purchase coverage?

No worries!

If you are able to persuade your son, daughter, or family member to pay your burial insurance premium, most insurance companies will allow you to do that.

That way you can get the coverage you need while removing your financial burden from the family members who most likely would pay the funeral cost out-of-pocket.

Reason #92 – Burial insurance has easier underwriting compare to fully underwritten life insurance

By now you’ve seen the list of health conditions burial insurance covers.

What’s amazing is that most traditional life insurance products will NOT take these conditions, making the approval process extremely difficult if not outright impossible.

If you want an easier time getting approval for life insurance coverage, consider a final expense policy.

Reason #93 – Blood thinners like Coumadin, Warfarin and Plavix may be acceptable

Beware.

If you take heavy blood thinners like coumadin, Warfarin, and Plavix, you may end up getting rate-ups and declines with life insurance companies, even with some burial insurance companies.

We at Buy Life Insurance For Burial know which companies accept these types of medications, and give you a better opportunity for preferred coverage.

Reason #94 – Burial insurance is easy to qualify with the phone

Not fond of doing any business over the computer?

If that’s the case, there are a handful of burial insurance companies that operate using telephonic applications.

The process is simple.

Instead of completing an electronic or paper application, you authorize the company to complete the application for you over the phone.

In addition, you commonly get a decision on your eligibility for insurance at the end of the 15-minute phone call. Talk about fast!

Reason #95 – Burial insurance is easy to qualify over email

Like the idea of completing your application electronically?

Not a problem. Most final expense companies offer “point and click” burial insurance applications you can do in the comfort of your own home at your computer.

Reason #96 – Paper applications are fine, too

Do you just prefer the old fashioned way in applying for burial insurance coverage?

You can still do this way and insurance companies can easily process your application.

Reason # 97 – You can own as much burial insurance as you want

Assuming you’re approved for coverage, there are no rules that limit the amount of coverage you can own.

You can own as much as you want, from any company that will approve you. Owning coverage with multiple companies is OK, too.

Reason #98 – Burial policy protects your savings

Many people buy a burial insurance plan out of a desire to keep savings plan separate from final expenses.

Many people want to pass their savings directly to their heirs without any proceeds going towards the funeral bill.

A final expense plan comes in handy here, allowing your funeral expenses to be covered without getting into your savings.

Reason #99 – Relieve the burden of your loved ones

What’s the main reason we get burial insurance coverage?

Simple. It’s to relieve the burden of our loved ones paying for our funeral bill.

It’ll be hard enough on them grieving. Having burial insurance eliminates dealing with financial burdens.

Reason #100 – Get control of your planning

Buying a burial insurance policy is the first step for many in planning their final arrangements.

And it’s an important step, too.

Plans are worth nothing if there isn’t any money to fund them.

So get a burial insurance policy to start the process of taking care of your final expenses.

Burial Insurance Rates, Age 40 to 90*

Rates For $5,000 In Burial Insurance

Rates For $10,000 In Burial Insurance

Rates For $15,000 In Burial Insurance

Rates For $20,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

*Burial insurance premiums are subject to underwriting, based on rates as of 8/20/2018, from state-regulated life insurance companies offering final expense burial whole life insurance protection. Understand that in order to potentially qualify, you must submit an application to see if you’re eligible. Rates are subject to change. Give Buy Life Insurance For Burial a call at 888-626-0439 now to see what program you may qualify for.

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Hope you enjoyed our article.

If you’re interested in learning what burial insurance options you may qualify for, feel free to call us at (888) 626-0439.

Alternatively you can send us a message here. We will respond within 24 business hours. We look forward to speaking with you.